ieStarGate LP Consulting

940-725-3251

Business Plan Components

(mouse over)

Income Statement

Cash Flow

Balance Sheet

Generally Accepted Accounting Principles (GAAP)

Operating

Expenses

Human

Resources

Sales

Forecast

Organization

Personnel

Benefits

Units

COGS

Revenue

Dept.

Budgets

Investor

Analysis

Valuation

Industry Metrics

Deal Structure

Cap Table

Getting Started

The main objective of any for-profit business is to maximize earnings. Earnings are the result of income less expenses. Sounds simple. Reality says otherwise.

Only 50% of startups survive 5 years and only 30% for 10 years. Overwhelmingly the two most common reasons of failure are the lack of planning and insufficient funding. The two are directly connected. Without a credible plan, raising sufficient funds, particularly from sophisticated investors, is highly improbable.

A credible plan is one that demonstrates why expected results are reasonably achievable. For example, how many accounts can be closed? What is the expected product or service cost of goods? What are the customer acquisition costs? And, more importantly, why are your expectations able to be realized?

Revenue Forecast

The most important module of your Financial Pro Forma is the Revenue Forecast since it drives your income and required expenses including, among others, the cost to deliver your goods and/or services, your departmental budgets, human resources, and capital expenditures.

The number of accounts for each of your products and/or services should be based on the number of sales channels (direct sales, distributors, online, etc.), the number of sales representatives or website visitors and the number of accounts closed per representative or per thousand site visitors. Converting unit sales to revenues must consider lead times and payment terms. Additionally, seasonal fluctuations, promotions, trade shows, and marketing strategies must be considered.

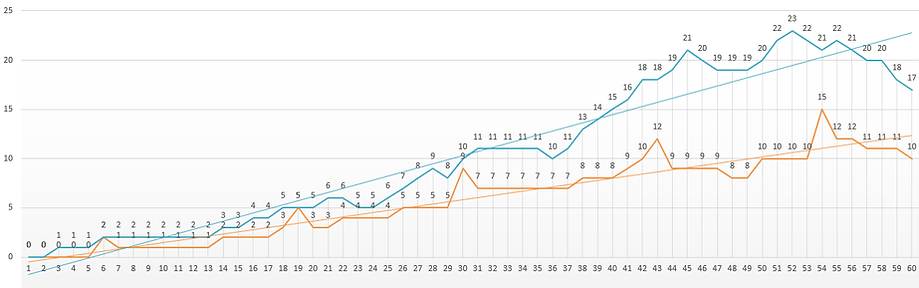

Five-Year Unit Forecast by Sales Channel

The Revenue Forecast must reflect your company's business model and how you plan to implement it. No two businesses are alike and no two Business Plans are alike. Using a "one size fits all" template to create your forecast will not result in a revenue stream aligned with your unique strategies and planned implementation methodologies. Almost without exception the Revenue Forecast requires a customized module, built from scratch, to create a credible revenue forecast for your unique business concept.

Human Resources

No two companies have the same organization, department budgets, capital expenditures, or personnel policies. Therefore, to accurately identify and forecast these expenditures for your company, a customized Human Resources module must be constructed.

Financial Statements

Once your income and expense forecasts have been quantified, they are used to produce your projected income, cash flow, and balance sheet which reflect your company's future financial performance. This component of the financial model commonly uses industry standard Generally Accepted Accounting Principles (GAAP).

Investor Analysis

Every investor will push your financial statements through a series of analyses to determine the upsides and downsides (risks) of investing in your business.

-

Breakeven Analysis - determines when your plan expects to achieve sustained profitability

-

Sensitivity Analysis - determines how sensitive your business is to income and expense variations

-

Ratio Analysis - compares your financial performance against average industry performance

-

Pre-Money Analysis - verifies the value of the company at the time of the investment

-

Company Valuation - determines the future value of the company and the investment return

-

Competitive Analysis - identifies your company's competitive advantages and value proposition

-

Case Studies - identifies similar successful strategies

-

Deal Structure - determines the ability to meet the investor's own investment objectives

To ensure these analyses use the correct assumptions and accurately reflect your business, each analysis should be performed and the results provided to prospective investors.